While 2024 was certainly a year of contradictions for the recreational boating sector, steps forward outnumbered steps back as the industry prepares for better days ahead

2024 was the year of the dragon on the Chinese zodiac but for the leisure marine sector, 2024 could be more accurately described as the year of the dichotomy.

On one hand, 2024 was clearly a year flush with positives for the industry, with multiple boatbuilders and equipment manufacturers announcing factory expansions, new distribution agreements, and new dealership partners – all at a time when supposedly no one wanted to take on any new inventory at all due to high wholesale financing costs. Companies signing multiple new partners in their sales channels isn’t supposed to happen during a down market, yet IBI’s daily newsletters featured one such announcement after the next all throughout the year.

Yet amid those successes, unfortunate evidence that the sector isn’t yet in fully calm seas could not be ignored, with further reports of financial losses and headcount reductions. Jubilation remained mixed with heartache.

Yet despite the turmoil and contradictory headlines, some consensus exists. Here’s our take – see if you agree.

M&A is alive and well

Patrick acquires Sportech. Yamaha acquires Torqeedo. Amphenol acquires Airmar. Quick Group acquires Yachting Marine Service. Zerojet merges with Tectrax. MarineMax acquires Williams Tenders USA, then Aviara. The level of M&A activity through 2024 shows a strong level of confidence as the industry moves forward, with key players increasingly looking to distance themselves from competitors by adding differentiating competencies.

Stable supply networks matter

In the wake of 2021’s global supply chain meltdown, logistics upheavals through 2022, rising geopolitical tensions, war in Ukraine and the Middle East, and the renewed threat of trade wars as Donald Trump prepared to begin a second term as US president in January, secure and reliable supply networks have never been more important. That is especially true as boat builders and major wholesale distributors look to in-market supply hubs as a point of supply security. Leveraging technology to support key customers with dedicated mini plants can pay enormous dividends by protecting important contracts while keeping competitors out.

Exporting remains a winning strategy

As markets contracted in the US and Europe through 2024, boat sales flourished in Latin America.

Offsetting a soft market in one region with gains in another continues to make sound business sense, as evidenced by the startling number of announcements throughout the year trumpeting new distribution partnerships and companies opening overseas sales offices.

Performance claim validations carry real weight

It’s one thing to make a great product. It’s another thing entirely to have an independent third party verify it. Manufacturers are increasingly investing in independent validation of product performance claims in order to bury imitators in crowded market segments.

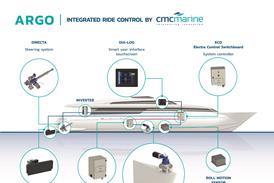

Collaborations mean business

For some time IBI has observed the rise in collaborations between firms with complementary value propositions, and this trend continues to gain traction. The ability to leverage a trusted partner’s technical expertise and manufacturing resources affords cost certainty with high product quality, making collaboration increasingly attractive – especially in a soft market when lower volumes impact production efficiencies.

Tariffs? Whatever

US president-elect Donald Trump says tariffs are a beautiful thing, and has already spoken about his desire to impose new levies on Canada, Mexico and China immediately upon taking office next month.

The attitude among businesses both within and outside of the leisure marine sector seems to be one of This again? Unlike 2018, when Trump first began imposing tariffs on imported goods during his first term in office, today’s attitude isn’t one of fear of the unknown, but annoyance with a familiar headache. Business leaders have described the return of tariffs as a short-term frustration almost certain to disappear at the end of Trump’s term. Manufacturers have been down this road before, and they appear to feel more confident dealing with trade barriers today.

So what will 2025 bring? We’ll all just have to wait and see. But with the boating industry looking increasingly confident and engaged, interest rates and inflation levels continuing to drop and a growing addressable market, there is sound reason to believe that 2025 will represent an improvement over 2024, and perhaps the start of a sustained growth period for the sector. Let’s hope.

LinkedIn

LinkedIn X / Twitter

X / Twitter Facebook

Facebook Email us

Email us